Blog

Welcome to AC STEEL

Scrap is gaining popularity in industries because of its economic and environmental benefits. By repurposing discarded materials, we reduce the need for new resources and decrease waste in landfills. As a result, the use of scrap is essential for achieving sustainable development and creating a more responsible future.

Ecodesign

Ecodesign has become an increasingly important concept in recent times; it has garnered much attention due to its role in advancing sustainable practices and environmental awareness. The main objective of ecodesign is to minimize the adverse effects of human activities on the environment. The incorporation of metal scrap is one key way to achieve this objective. By using metal scrap, ecodesign helps to reduce waste and the environmental impact of metal production. Moreover, using metal scrap saves costs that would have been associated with acquiring new materials since metal scrap is readily available and cheaper. Therefore, incorporating metal scrap into ecodesign offers significant advantages both to the environment and the economy.

Recycling

Recycling metal scrap is an environmentally responsible and cost-efficient practice that offers numerous benefits to our economy. By choosing to recycle metals such as aluminum, copper, steel and brass, we can significantly reduce the costs of extracting new ore and conserve valuable resources. The processing and extraction of new ores consume significant amounts of energy, whereas recycling scrap metal requires less energy and, therefore, results in lower greenhouse gas emissions. Additionally, recycling provides a steady supply of raw materials at a lower cost, which can result in increased economic savings and job creation. Together, these benefits make recycling metal scrap a smart choice for any individual or business looking to reduce their environmental footprint and cut costs.

Use of metal scrap

The world generates a significant amount of scrap metal on a daily basis, which poses a threat to our surroundings. Nevertheless, the shift toward sustainable and eco-friendly practices has sparked a rekindled interest in discovering novel ways to utilize metal scraps. Fortunately, due to technological advancements, there are now several ways to repurpose metal scrap, which includes recycling, reusing, and upcycling. Recycling entails transforming scrap metal into fresh raw materials that can be used in the production of a variety of industrial and consumer goods, while reusing involves utilizing the scrap in its original form to generate new items. Meanwhile, upcycling involves transforming scrap metal into more valuable or creative goods.

Studies

Copper: Premimary Data for December 2023

Date: 20th February 2024

Copper: Preliminary Data for December 2023

International Copper Study Group

World copper production in 2023 saw a 1% increase, but operational constraints limited growth in Chile, China, Indonesia, Panama, and the United States. Technical issues, reduced grades, and drought in central Chile lowered production by 1.5%. Indonesia’s output fell by 7.5%, and Panamanian production decreased by 5.5%. The United States output fell by 8%, Chinese production by 10%, and Peru increased production by 13%. The D.R.Congo’s production grew by 5%, and Mongolia’s production increased by 17%.

Initial data shows world copper production rose by 6% in 2023. Primary production increased by 5% and secondary production went up by 9%. The rise was mainly due to growth in China and the DRC, with a decline in production elsewhere. World apparent refined copper usage grew by 4%, supported by strong demand in China. Usage in the rest of the world declined.

In 2023, the world refined copper balance indicates a preliminary deficit of about 87,000 t, but adjusted for estimated changes in Chinese bonded stocks, the deficit is about 113,000 t. Copper stocks held at the major metal exchanges increased slightly in January 2024, with the LME cash price down 0.6% from December. The year’s average was 2% below 2023.

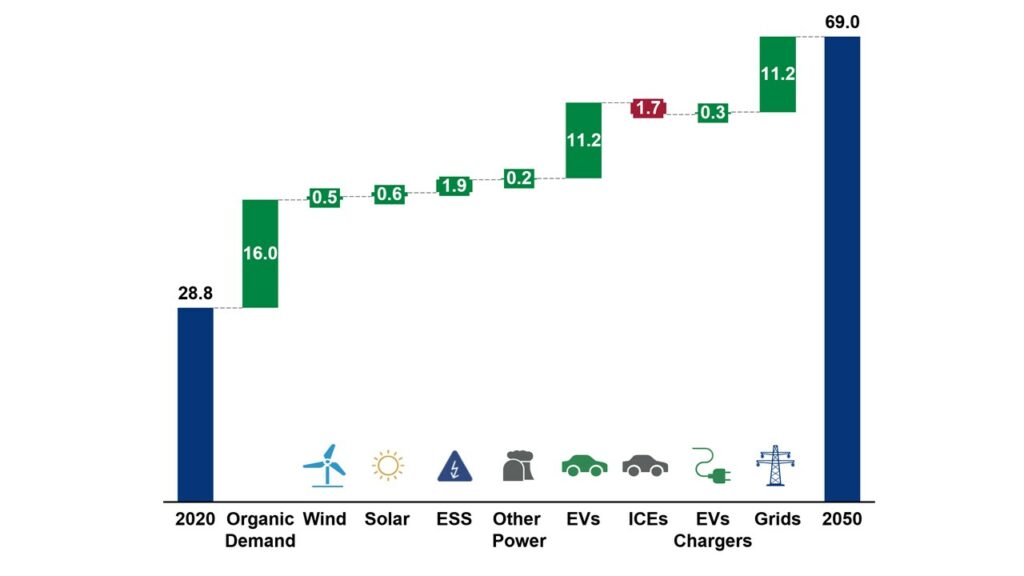

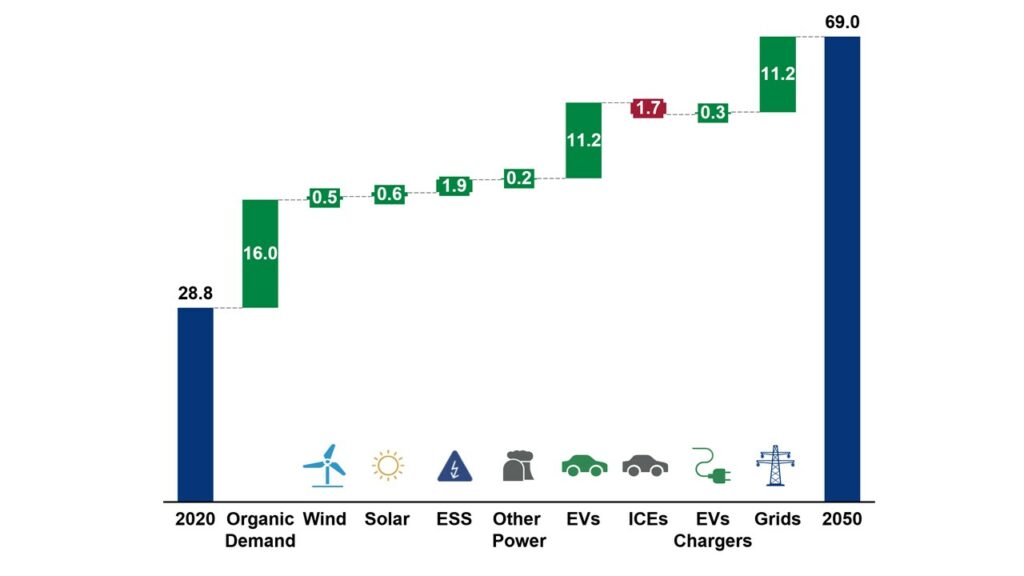

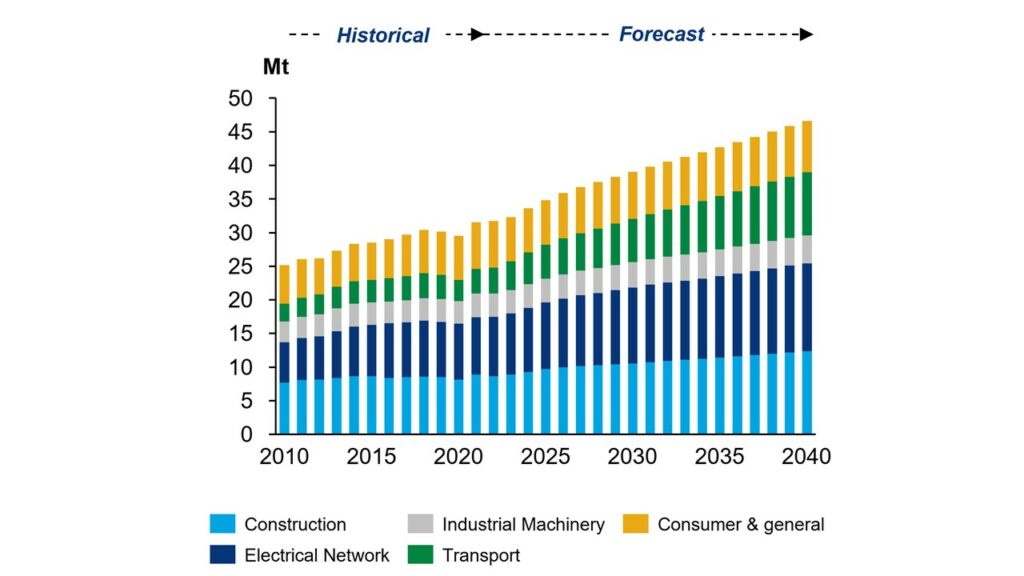

Copper demand growth by sector 2050

Date: 7th December 2023

Copper demand growth by sector 2050

In 2050, copper demand will increase to 69 million tonnes from 28.8 million tonnes in 2020.

Recent studies indicate that the demand for copper is expected to experience a significant increase in the coming decades. The demand is forecasted to surge from 28.8 million tonnes in 2020 to an impressive 69 million tonnes by 2050. This rise in demand can be attributed to several factors, including the growth of emerging markets, an expansion in energy networks worldwide, and an increase in the production of electric vehicles globally. In particular, the production of electric vehicles alone will contribute to an increase in demand by 11.2 million tonnes, and the expansion of energy networks will contribute a further 11.2 million tonnes. These trends present a promising future for the global copper industry, offering hope for continued growth and development in the years ahead.

Value in millions of tons

source: Wood Mackenzie analysis

Copper: Preliminary Data for September 2023

Date: 20th November 2023

Copper: Preliminary Data for September 2023

International Copper Study Group

According to recent data, world copper mine production has seen a modest increase of 1.1% in the first nine months of 2023. Concentrate production increased by 1.3% and solvent extraction-electrowinning grew by 0.2%. While the industry has benefitted from start-ups and expansions, it has faced some operational challenges in countries like Chile, China, Indonesia, Panama, and the US, particularly in the first half of this year. Production in Chile declined by 1.9%, however, it improved in the third quarter. Indonesian output was down by 9%, Panamian growth was limited at 3%, US output declined by 10%, Chinese production was 6% lower, while Peru’s mine production increased by 16%. The output in D.R.Congo is estimated to have grown by about 7%.

During the first nine months of 2023, the global production of refined copper experienced growth of 5.3%. Primary production increased by 4.8% while secondary production went up by 7.5%. Strong performances in China and the DRC led to global output growth, although other countries faced declines of 0.7%. Chinese refined production surged by approximately 13% and DRC output also expanded by 5%. In contrast, Chilean total refined copper production decreased by 3.8%, and other significant producing nations faced similar drops. Secondary refined production surged by 7.5%, owing mostly to China. During the same period, world apparent refined copper usage increased by 3%, primarily driven by robust demand in China. Conversely, the EU, Japan, and the US saw a reduction in demand, leading to a decline in world ex-China refined usage of about 3%.

As per the International Copper Study Group (ICSG), the global refined copper market is estimated to have a surplus of about 17,000 t in the initial nine months of 2023. It is important to note that the ICSG does not take into account the changes in unreported stocks for China’s apparent demand calculation. However, an added line item in the table adjusts the refined copper balance on the basis of estimated changes in bonded inventories provided by consultants. The preliminary surplus as per China’s apparent usage indicates about 17,000 t, whereas the adjusted balance indicates a surplus of about 35,000 t. It is imperative to keep track of such estimates to make well-informed decisions in the global market.

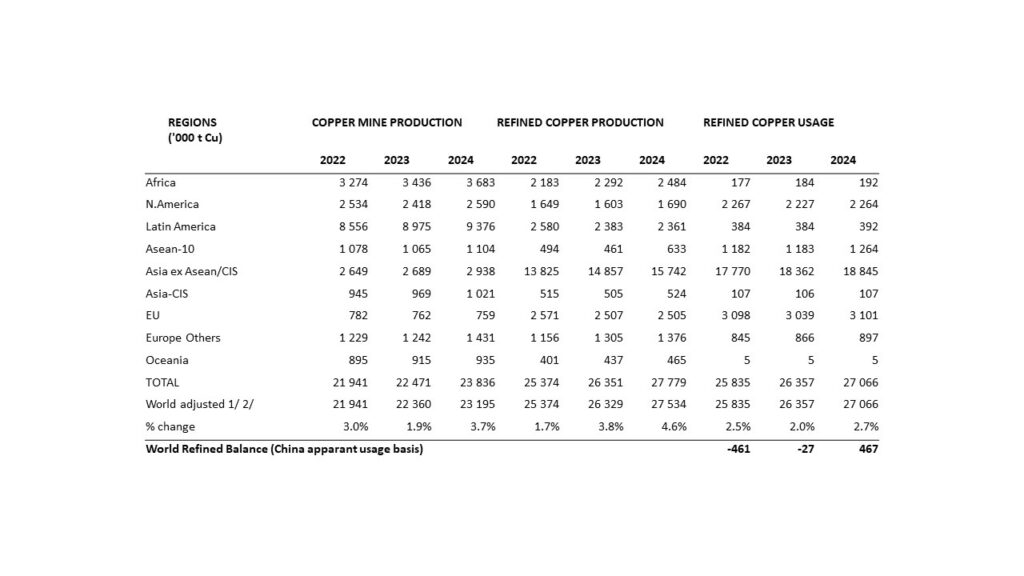

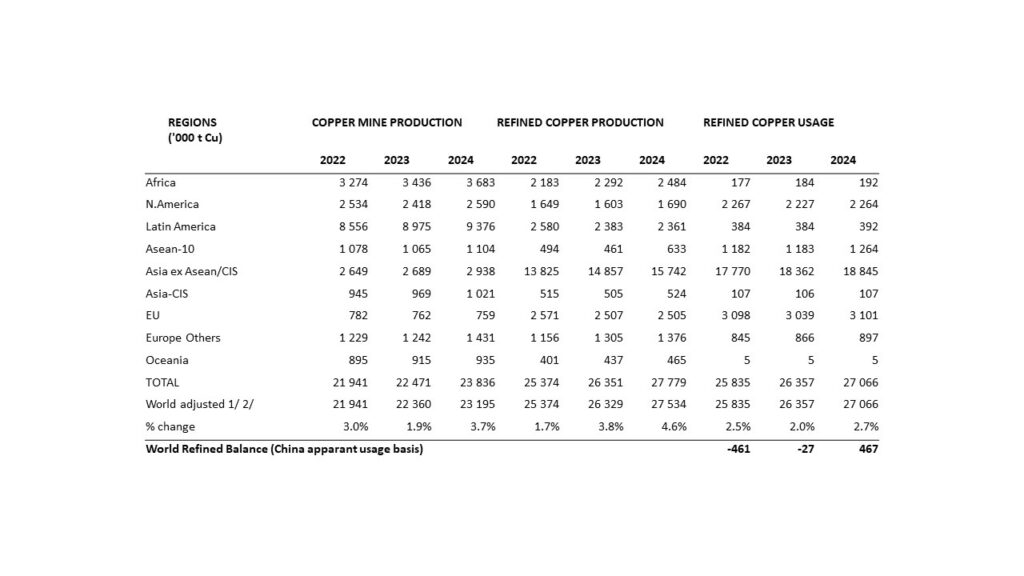

Copper Market Forecast 2023/2024

Date: 4th October 2023

Copper Market Forecast 2023/2024

International Copper Study Group

“World refined copper production is forecast to rise by about 3.8% in 2023 and 4.6% in 2024.”

In the upcoming years, it is foreseen that there may be certain challenges affecting copper production in Chile, Indonesia, Sweden, and the United States. However, the industry is expected to witness new smelters and refineries opening up in Indonesia, India, and the United States in 2024, coupled with increased Chinese production, which should mitigate any potential impact of the lost production. Furthermore, the opening of new mines is predicted to generate more copper output. In terms of electrowinning, the Democratic Republic of Congo’s rise in production is anticipated to offset Chile’s decline. On the positive side, the addition of new facilities is expected to increase scrap metal recycling, resulting in increased production forecasts for both 2023 and 2024.

According to the latest copper market projections, global refined copper usage is expected to observe a crucial growth of 2% in 2023, primarily driven by the robust demand from China. In contrast, ex-China usage may face a decline of 1%, with anticipated contractions in North America and EU countries markets. Despite the challenging economic scenario, the growth of new semis production capacity and escalating manufacturing activities are presumed to bolster global refined copper usage by 2.7% in 2024. Copper has become a vital component for economic and technological activity, with developing infrastructure and the transition towards cleaner energy and electric vehicles boosting the long-term demand for this essential metal.

Based on the latest projections, the global refined copper balance is anticipated to report a deficit of 27,000t in 2023, followed by a surplus of 467,000t in 2024. However, it is important to consider the possibility of unforeseen events which could potentially impact these figures. Additionally, unreported copper stocks in China could affect the global supply-demand balance, as the projected apparent demand calculation does not account for them. It is worth noting that the projected deficit for 2023 has decreased compared to previous forecasts, which can be attributed to an expected increase in Chinese usage. Conversely, the projected surplus for 2024 is higher due to additional supply. We will continue to monitor these trends and provide updates as needed.

Copper used

Date: 3th October 2023

Nearly 28 million tonnes of copper are used annually.

Copper is a highly versatile metal that is widely utilized globally for various applications. Every year, the world uses approximately 28 million tonnes of copper, with 70% directed towards electricity and communication systems. Copper’s remarkable electrical conductivity makes it the preferred material, accounting for 44% usage, to power homes and businesses. Furthermore, copper contributes to electrical equipment by providing circuitry, wiring, and contacts for appliances and electronic devices, accounting for 14% of usage. In the transport sector, copper is indispensable for high purity wire harness systems in trains, cars, and trucks used to connect to equipment such as lights, computers, and satellite navigation, accounting for 12% of copper usage. With its durability, low maintenance structures, and recyclability, copper is employed in 20% of building materials. Copper is also used in producing sculptures, coins, jewelry, musical instruments, cookware, and other consumer goods, accounting for 10% of copper usage.

Major End Used Copper

No Data Found

Copper is an essential and versatile material that goes through several significant life cycle phases, each with its unique attributes. The first stage involves mining, which consists of extracting copper ore from the earth’s crust. Following mining, smelting and refining processes purify the extracted ore. Semi-fabrication transforms copper into various forms that can be further refined or shaped as required, leading to the manufacturing stage where finished products are produced from semi-finished ones. During the use phase, copper is used in different applications to improve people’s quality of life. Lastly, recycling enables the end-of-life products to return to the production cycle, reducing waste and conserving natural resources. Recycling activities occur at both smelters and fabricators that aim to produce copper and semi-finished products.

Copper: Premimary Data for December 2023

Date: 20th November 2023

Copper: Preliminary Data for September 2023

International Copper Study Group

According to recent data, world copper mine production has seen a modest increase of 1.1% in the first nine months of 2023. Concentrate production increased by 1.3% and solvent extraction-electrowinning grew by 0.2%. While the industry has benefitted from start-ups and expansions, it has faced some operational challenges in countries like Chile, China, Indonesia, Panama, and the US, particularly in the first half of this year. Production in Chile declined by 1.9%, however, it improved in the third quarter. Indonesian output was down by 9%, Panamian growth was limited at 3%, US output declined by 10%, Chinese production was 6% lower, while Peru’s mine production increased by 16%. The output in D.R.Congo is estimated to have grown by about 7%.

During the first nine months of 2023, the global production of refined copper experienced growth of 5.3%. Primary production increased by 4.8% while secondary production went up by 7.5%. Strong performances in China and the DRC led to global output growth, although other countries faced declines of 0.7%. Chinese refined production surged by approximately 13% and DRC output also expanded by 5%. In contrast, Chilean total refined copper production decreased by 3.8%, and other significant producing nations faced similar drops. Secondary refined production surged by 7.5%, owing mostly to China. During the same period, world apparent refined copper usage increased by 3%, primarily driven by robust demand in China. Conversely, the EU, Japan, and the US saw a reduction in demand, leading to a decline in world ex-China refined usage of about 3%.

As per the International Copper Study Group (ICSG), the global refined copper market is estimated to have a surplus of about 17,000 t in the initial nine months of 2023. It is important to note that the ICSG does not take into account the changes in unreported stocks for China’s apparent demand calculation. However, an added line item in the table adjusts the refined copper balance on the basis of estimated changes in bonded inventories provided by consultants. The preliminary surplus as per China’s apparent usage indicates about 17,000 t, whereas the adjusted balance indicates a surplus of about 35,000 t. It is imperative to keep track of such estimates to make well-informed decisions in the global market.

Copper demand growth by sector 2050

Date: 7th December 2023

Copper demand growth by sector 2050

In 2050, copper demand will increase to 69 million tonnes from 28.8 million tonnes in 2020.

Recent studies indicate that the demand for copper is expected to experience a significant increase in the coming decades. The demand is forecasted to surge from 28.8 million tonnes in 2020 to an impressive 69 million tonnes by 2050. This rise in demand can be attributed to several factors, including the growth of emerging markets, an expansion in energy networks worldwide, and an increase in the production of electric vehicles globally. In particular, the production of electric vehicles alone will contribute to an increase in demand by 11.2 million tonnes, and the expansion of energy networks will contribute a further 11.2 million tonnes. These trends present a promising future for the global copper industry, offering hope for continued growth and development in the years ahead.

Value in millions of tons

source: Wood Mackenzie analysis

Copper: Preliminary Data for September 2023

Date: 20th November 2023

Copper: Preliminary Data for September 2023

International Copper Study Group

According to recent data, world copper mine production has seen a modest increase of 1.1% in the first nine months of 2023. Concentrate production increased by 1.3% and solvent extraction-electrowinning grew by 0.2%. While the industry has benefitted from start-ups and expansions, it has faced some operational challenges in countries like Chile, China, Indonesia, Panama, and the US, particularly in the first half of this year. Production in Chile declined by 1.9%, however, it improved in the third quarter. Indonesian output was down by 9%, Panamian growth was limited at 3%, US output declined by 10%, Chinese production was 6% lower, while Peru’s mine production increased by 16%. The output in D.R.Congo is estimated to have grown by about 7%.

During the first nine months of 2023, the global production of refined copper experienced growth of 5.3%. Primary production increased by 4.8% while secondary production went up by 7.5%. Strong performances in China and the DRC led to global output growth, although other countries faced declines of 0.7%. Chinese refined production surged by approximately 13% and DRC output also expanded by 5%. In contrast, Chilean total refined copper production decreased by 3.8%, and other significant producing nations faced similar drops. Secondary refined production surged by 7.5%, owing mostly to China. During the same period, world apparent refined copper usage increased by 3%, primarily driven by robust demand in China. Conversely, the EU, Japan, and the US saw a reduction in demand, leading to a decline in world ex-China refined usage of about 3%.

As per the International Copper Study Group (ICSG), the global refined copper market is estimated to have a surplus of about 17,000 t in the initial nine months of 2023. It is important to note that the ICSG does not take into account the changes in unreported stocks for China’s apparent demand calculation. However, an added line item in the table adjusts the refined copper balance on the basis of estimated changes in bonded inventories provided by consultants. The preliminary surplus as per China’s apparent usage indicates about 17,000 t, whereas the adjusted balance indicates a surplus of about 35,000 t. It is imperative to keep track of such estimates to make well-informed decisions in the global market.

Copper Market Forecast 2023/2024

Date: 4th October 2023

Copper Market Forecast 2023/2024

International Copper Study Group

“World refined copper production is forecast to rise by about 3.8% in 2023 and 4.6% in 2024.”

In the upcoming years, it is foreseen that there may be certain challenges affecting copper production in Chile, Indonesia, Sweden, and the United States. However, the industry is expected to witness new smelters and refineries opening up in Indonesia, India, and the United States in 2024, coupled with increased Chinese production, which should mitigate any potential impact of the lost production. Furthermore, the opening of new mines is predicted to generate more copper output. In terms of electrowinning, the Democratic Republic of Congo’s rise in production is anticipated to offset Chile’s decline. On the positive side, the addition of new facilities is expected to increase scrap metal recycling, resulting in increased production forecasts for both 2023 and 2024.

According to the latest copper market projections, global refined copper usage is expected to observe a crucial growth of 2% in 2023, primarily driven by the robust demand from China. In contrast, ex-China usage may face a decline of 1%, with anticipated contractions in North America and EU countries markets. Despite the challenging economic scenario, the growth of new semis production capacity and escalating manufacturing activities are presumed to bolster global refined copper usage by 2.7% in 2024. Copper has become a vital component for economic and technological activity, with developing infrastructure and the transition towards cleaner energy and electric vehicles boosting the long-term demand for this essential metal.

Based on the latest projections, the global refined copper balance is anticipated to report a deficit of 27,000t in 2023, followed by a surplus of 467,000t in 2024. However, it is important to consider the possibility of unforeseen events which could potentially impact these figures. Additionally, unreported copper stocks in China could affect the global supply-demand balance, as the projected apparent demand calculation does not account for them. It is worth noting that the projected deficit for 2023 has decreased compared to previous forecasts, which can be attributed to an expected increase in Chinese usage. Conversely, the projected surplus for 2024 is higher due to additional supply. We will continue to monitor these trends and provide updates as needed.

Copper used

Date: 3th October 2023

Nearly 28 million tonnes of copper are used annually.

Copper is a highly versatile metal that is widely utilized globally for various applications. Every year, the world uses approximately 28 million tonnes of copper, with 70% directed towards electricity and communication systems. Copper’s remarkable electrical conductivity makes it the preferred material, accounting for 44% usage, to power homes and businesses. Furthermore, copper contributes to electrical equipment by providing circuitry, wiring, and contacts for appliances and electronic devices, accounting for 14% of usage. In the transport sector, copper is indispensable for high purity wire harness systems in trains, cars, and trucks used to connect to equipment such as lights, computers, and satellite navigation, accounting for 12% of copper usage. With its durability, low maintenance structures, and recyclability, copper is employed in 20% of building materials. Copper is also used in producing sculptures, coins, jewelry, musical instruments, cookware, and other consumer goods, accounting for 10% of copper usage.

Major End Used Copper

No Data Found

Copper is an essential and versatile material that goes through several significant life cycle phases, each with its unique attributes. The first stage involves mining, which consists of extracting copper ore from the earth’s crust. Following mining, smelting and refining processes purify the extracted ore. Semi-fabrication transforms copper into various forms that can be further refined or shaped as required, leading to the manufacturing stage where finished products are produced from semi-finished ones. During the use phase, copper is used in different applications to improve people’s quality of life. Lastly, recycling enables the end-of-life products to return to the production cycle, reducing waste and conserving natural resources. Recycling activities occur at both smelters and fabricators that aim to produce copper and semi-finished products.