Analysis

We provide a analyzes of the non-ferrous metal scrap market

We are a provider of comprehensive non-ferrous metal scrap market analyses. Wes use advanced technology and reliable data sources to deliver accurate market trends, pricing information and more. Our goal is to help you make informed decisions and achieve your business goals.

How can we help you?

We prepare opinions and analyzes of the non-ferrous metal scrap market in the European Union.

Data

Data acquisition is the process of gathering and collecting information from various sources using different techniques and methods.

Data Processing

Data processing is the process of collecting and manipulating data to extract meaningful information. This involves a series of steps, including data collection, data entry, data validation, data analysis, data transformation, and data visualization.

Data Analysis

Data analysis involves examining raw data with the aim of identifying patterns, relationships, and trends, and then drawing meaningful conclusions from such observations. Data analysis is an essential tool in problem-solving and decision-making processes across different industries, including healthcare, finance, marketing, and more.

Market Size

The concept of market size refers to the measurement of the magnitude of a particular market in terms of the potential opportunities it offers for businesses to grow, become more profitable, and expand their operations. It is a crucial aspect of market analysis since it provides businesses with a clear understanding of the size, growth rate, and demand patterns of their target market.

Forecasts

The scrap market in Europe has been experiencing a number of changes in recent years due to numerous factors such as economic growth, decreased availability of raw materials, and the rising popularity of sustainability initiatives. While the future prospects for the scrap market in Europe remain uncertain, many experts believe that the market will continue to grow and evolve as businesses seek out more environmentally-friendly and cost-effective solutions for their material needs.

Opinions

When it comes to preparing for anything in life, it's important to have opinions and perspectives from different sources. This allows us to broaden our perspective and consider different approaches to preparation. It's helpful to seek advice from experts and professionals in the field, as they often have invaluable insights to share.

"Right decisions based on good data and analysis."

Analysis: Import and Export of Non-ferrous Metals Scrap EU-27 Countries

(nformation prepared on the basis of Eurostat data)

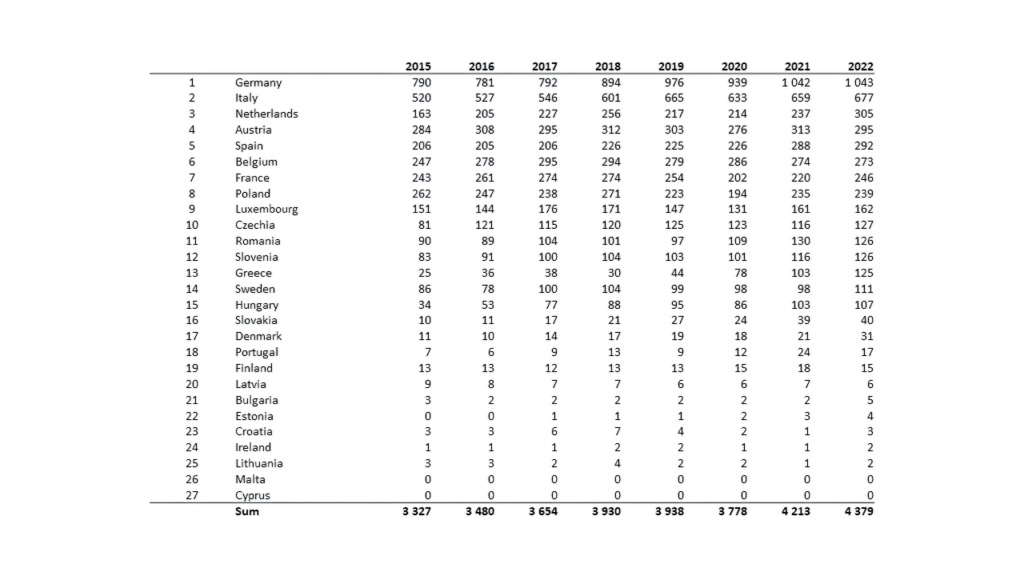

Import of aluminum scrap (2015 - 2022)

Poland has emerged as a key player in the scrap aluminum import market, with a total tonnage of 239,000 tons in 2022, representing a considerable portion of the European Union’s overall import numbers. This highlights the country’s significant contribution to the thriving trading of aluminum scrap within the EU and the global marketplace. The import data shows Poland’s strong economic growth and development, as it continues to rely on the import of raw materials for a robust manufacturing industry and strong trade relations.

Furthermore, the high volume of scrap aluminum imports signifies Poland’s determination to promote sustainable practices, which reflects the country’s commitment to the efficient management of industrial waste. The trend is aligned with the global movement towards a more sustainable industrial economy, emphasizing Poland’s position as a responsible global citizen. This impressive performance is a testament to the hard work and dedication of the country’s leaders and citizens, who continue to promote growth and development in Poland’s manufacturing sector.

Values in thousands of tons

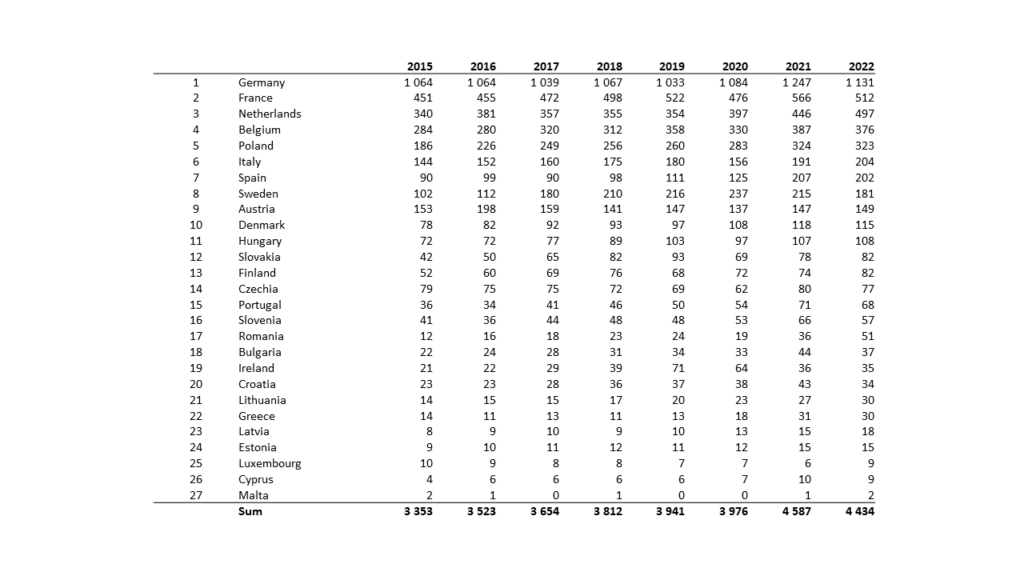

Export of aluminum scrap (2015 - 2022)

Poland has experienced a significant increase of 74% in aluminum scrap exports from 2015 to 2022, thanks to its thriving economy. With the country exporting a considerable 323 thousand tons of aluminum scrap last year, it made a remarkable contribution of approximately 7.3% to the total exports of European Union countries.

These numbers signify Poland’s dedication to solidifying and strengthening its economic standing in the global market while implementing sustainable practices in the manufacturing industry. The country’s abundance of natural resources and the technical expertise of its workforce have been instrumental in driving this growth.

Looking forward, Poland is forecasted to maintain this momentum, with further growth and expansion predicted for the aluminum scrap export sector. Overall, the future appears promising for Poland’s economy and its contributions to the European Union’s economic landscape.

Values in thousands of tons

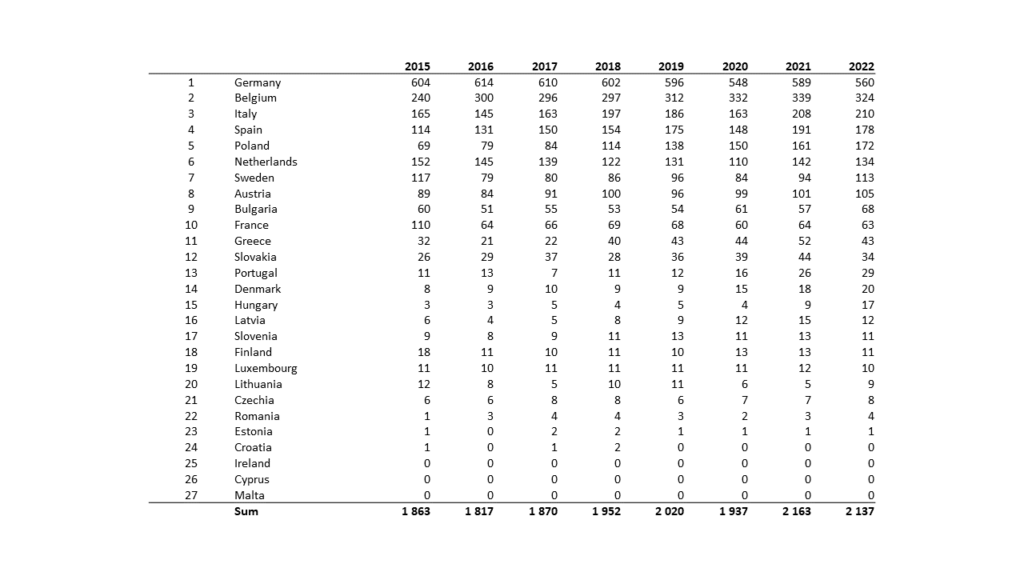

Import of copper scrap (2015 - 2022)

In 2022, Poland experienced a remarkable surge in copper scrap imports, with figures increasing by an astonishing 149% compared to those recorded in 2015. The country imported a significant 172 thousand tons of this valuable raw material, representing 8% of the total copper scrap imports from EU countries. This growth in copper demand is a testament to Poland’s unwavering dedication towards enhancing its industrial sector and invigorating its economy for the times to come. The impressive numbers showcase a vast potential for new business and investment prospects. Additionally, the trend underscores Poland’s commitment to sustainable production as copper is one of the most effortlessly recyclable metals globally.

Values in thousands of tons

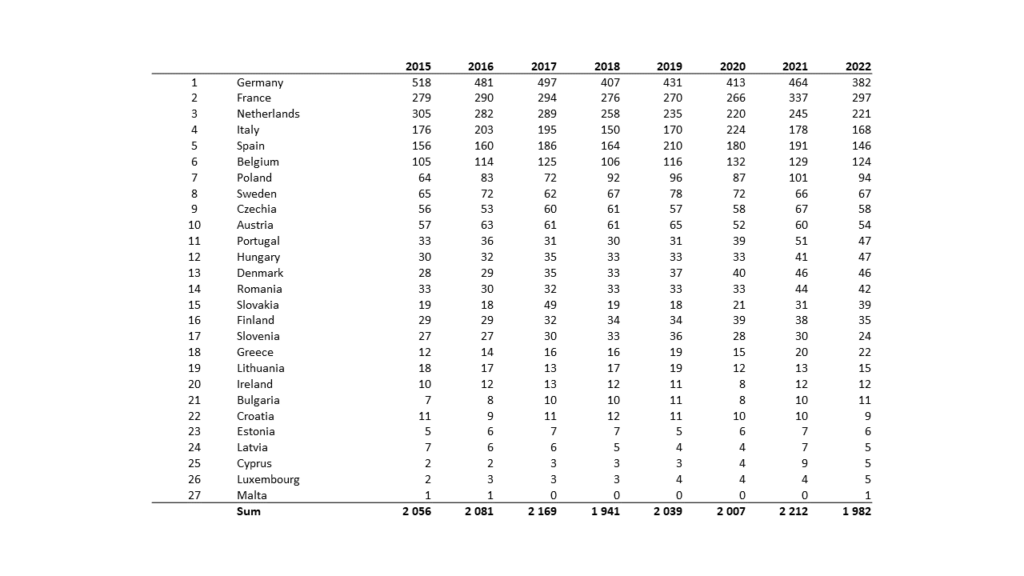

Export of copper scrap (2015 - 2022)

Poland has achieved impressive success in its copper scrap exportation growth trajectory in recent years. In 2022, the country exported 94 thousand tons of copper scrap, which accounts for an impressive 4.8% of the total scrap exports from all European Union countries. This notable achievement marks a significant increase of 47% in copper scrap exports between 2015 to 2022. This growth is indicative of the thriving scrap metal industry in Poland and the country’s emergence as a key player in the global market. The efficient scrap metal collection, recycling, and distribution systems put in place by Poland have undoubtedly contributed to this milestone’s success, enhancing the country’s competitive edge. Overall, Poland’s success in copper scrap exportation attests to the country’s unwavering commitment to industrial growth and economic development.

Values in thousands of tons